Crypto investors have to rely on several strategies to keep generating profits when the market is going through a bearish season and prices are declining continuously.

In this sense, a profitable trading strategy would be shorting the market. This type of strategy can help a crypto trader to profit off price declines, managing the risk associated with each move and hedging his/her portfolio.

In this article, we will discuss how cryptocurrency shorting works and how to profit off this strategy.

Table of Contents

How to Short Play in Financial Markets – Understanding the Concept

Before you run to buy bitcoin with credit card to start shorting cryptocurrencies, make sure to grasp the concept. Short selling, a short play, or “shorting” comes from the traditional stock market jargon. Here is the explanation:

- An investor (A) is bearish on an (X) stock, that he believes will decrease in value soon

- Then, investor (A) puts up the required collateral to borrow a specific amount of this specific (X) stock and immediately sells it on the market

- Consequently, a short position was opened and investor (A) has to wait a bit now.

- In case the market goes lower, investor (A) will buy back the same amount of (X) stock that was borrowed and pay back the lender with interest.

- Hence, the profit generated by the investor (A) is the difference between the price he initially sold (X) stock and the price he rebought it.

Cryptocurrency shorting is not different. If an investor (A) decides to sell a certain digital asset position at $20,000 just to rebuy it later at $15,000, it means he is shorting in the cryptocurrency market.

Notice that, throughout the process, investor (A) did not have the asset he wanted to sell to turn into profit as he was “short” of it. Commonly, short selling involves some sort of borrowed assets, even though not all cases are equal.

Is Cryptocurrency Shorting Risky?

Undoubtedly, yes – but only if you do not know what you are doing. Indeed, many crypto traders suffered huge losses over the years while being short on cryptocurrencies. For more on the risks of shorting, you have to see what happened with GameStop and how it made Wall Street firms lose $13B dollars.

In a similar line, some experts think that BTC could be the next GameStop because it could liquidate several short positions as it keeps growing bigger and bigger.

Firstly, traders need to determine what their potential loss may be in case things did not go as expected.

Nowadays, many platforms will liquidate a position before an investor arrives at a negative balance, which is a positive move. However, traders must be aware and stay up to date with all standard risk management tactics such as using stop-loss, for instance.

How to Make a Short Position with Cryptocurrency

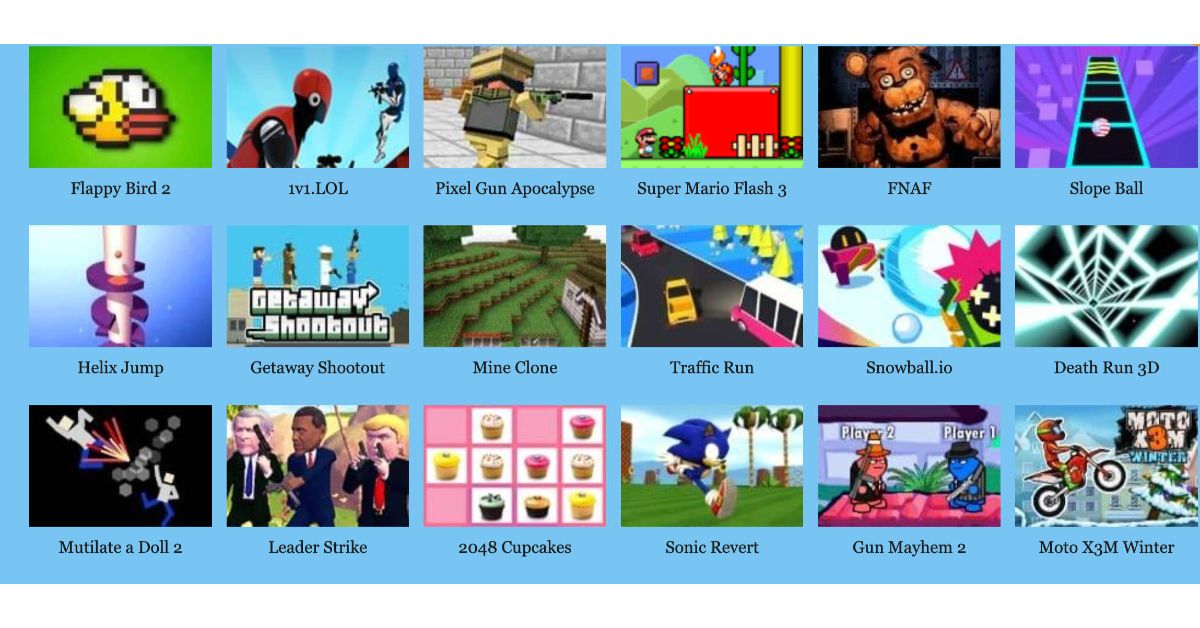

Nowadays, there are plenty of platforms in the market. Let us check the best options.

Shorting on Cryptocurrency Exchanges

One of the most common manners to play short on cryptocurrency is through crypto exchange platforms. Currently, several exchanges offer functionalities that permit crypto traders to perform shorting, including Bitfinex, Kraken, and BitMEX.

Some exchanges even offer the option for leveraged shorts, which means putting more money on a short than the amount you have deposited on the platform.

For instance, let us say investor (A) has $1000 worth of Bitcoin deposited on an exchange. Plus, he has a good leverage ratio that permits him to leverage a short play at even three times the original amount, which in this case could be even $3,000, for instance.

Nonetheless, this type of approach is risky, as the investor is performing with money he does not own. Hence, if the market moves unexpectedly, leveraged shorts will literally leverage the investor’s losses.

Contract for Difference (CFD)

A Contract for Difference (CFD) is an agreement in which two parties (buyer and seller) agree to pay the difference in prices as the value of a cryptocurrency rises or falls.

This method of shorting is different, as investors do not need to borrow an amount of crypto, sell it and then buy it back at a lower price. Hence, they do not need to buy the underlying asset itself, which saves money and time in the process.

Nowadays, several online platforms allow users to perform CFD trading, including EToro and Supply500. Be aware that this type of strategy is suitable for seasoned traders only, so if it is not your case, be careful.

Final Thoughts

Cryptocurrency markets are extremely volatile, so short-selling crypto-assets can be a great manner to profit off when cryptocurrency prices decline.

Indeed, shorting is a resourceful tool that can open a gateway for interesting ROIs through bearish markets – but only if the strategy is completed correctly.

Hence, if you want to short sell a cryptocurrency, you must take time to study the market, relying on math-based graphics and tendencies to determine if a short play is viable at all.